Equipment finance is an important part of the manufacturing industry’s cost structure. When used properly, equipment finance can help companies purchase new equipment at a reasonable price, thereby reducing overall expenses.

As a bonus, the benefits of equipment finance can extend beyond the purchase and installation of equipment. Equipment financing allows you to purchase the equipment you need without paying for it all upfront. This can save you money, and in some cases, you might be able to finance the equipment yourself, saving you even more money. You might also be able to qualify for additional loans or benefits from your employer, such as being able to get a larger loan through your employer’s credit union or an even lower interest rate.

Equipment financing is rapidly becoming the preferred financing method for manufacturers and equipment finance companies. Here are seven benefits of equipment financing that will help you determine if equipment financing is right for your business. Today’s industry bears little resemblance to that of a few decades ago. However, the changing landscape does not make it any less important; the manufacturing sector still employs a significant proportion of the workforce in any economy. The sector is expected to grow from $86.7 billion in 2020 to $117.7 billion in 2025, so its relevance will not change in the near future.

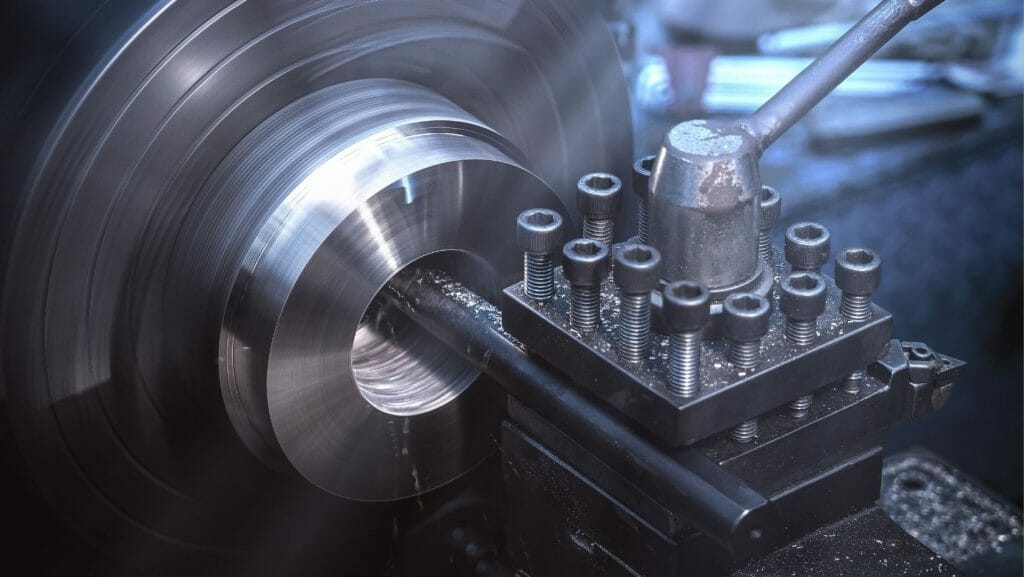

When it comes to changing the landscape, no factor has had a greater impact than technology. Thanks to the rapid development that constantly changes the processes in the manufacturing industry, today’s companies have become more efficient in terms of time and cost.

Like any other business, a manufacturing company needs to stay relevant in a competitive environment. This requires state-of-the-art equipment to achieve economies of scale and increase the efficiency of all processes. However, this technology is not cheap, making it increasingly important for companies to upgrade their equipment to meet market requirements. That’s where equipment financing comes in. Industrial equipment financing can help manufacturing companies get the equipment they need to grow their business at an affordable price from companies like Fasteners Suppliers. For a manufacturing company, equipment financing is a viable option as it offers significant benefits.

Here are seven ways the manufacturing industry can benefit from equipment financing:

Low risk

Managing a successful business requires careful attention to cash flow. Even if you have enough capital to buy new equipment, you should think twice before committing the full amount to a capital item. From a strategic standpoint, it may make sense to save an amount and use the funding to purchase equipment. Alternatively, heavy equipment rental is recommended because it may take some time for your company to recoup the capital invested in the equipment. If you opt for asset financing instead, you can use the remaining money to invest in other areas of your business that need immediate attention.

Enhancing competitive advantage

Upgrading equipment can help you improve the operations of your business and potentially increase the quality of the products you produce. This improvement can help your business increase its competitive advantage by helping to strengthen your brand, which in turn attracts more customers, sales and ultimately profits. Maintaining a firm’s competitive advantage is particularly important for firms operating in highly competitive industries dominated by multiple firms. The more companies compete for the same customers, the more important it is for them to continuously improve the quality of their products.

Protection against inflation

Industrial equipment is not cheap and you may have to wait several months or even a year to raise the capital to purchase it. The problem with waiting is that the price may go up in the future. Equipment financing allows you to lock in equipment at a price available in the market at the time. This pricing can have significant long-term benefits, as you are essentially getting the equipment at a lower price.

Substantial tax benefits

Financial payments for equipment are tax deductible. When you buy a new tool, you usually have to depreciate it every year. By the time you qualify for the amount of the annual tax credit, your equipment may be obsolete. When you finance equipment, you can treat the lease payments as an expense that is deducted from your business income each year during the lease term. In addition, the leased asset can be written off more quickly, making it easier to recover funds. In addition, you have to pay the taxes monthly in separate installments instead of paying the GST or PST all at once.

Improvement in purchasing power

The continuous monitoring of the credit or cash limit is an important aspect of business operations. Not having enough capital to buy the latest gadgets is incredibly frustrating. Machine leasing enables your company to purchase state-of-the-art industrial equipment and increases your purchasing power. You can easily purchase the equipment your business needs by making monthly payments that won’t put a dent in your business bank account. By spreading the cost of equipment over a longer period of time, you can provide your business with the equipment it needs to improve its production capacity and growth, resulting in increased productivity and profits.

Minimum initial payment

Your manufacturing business may need new equipment, but you may also need capital in other areas such as marketing, research and development, business expansion or the purchase of new premises. In this case, you can pay part of the financed amount at the beginning of the financing process. And in many cases, you don’t even have to pay a deposit. These flexible loan terms give you more control over your assets and allow you to prioritize your investments.

Credit enhancement

Just like an individual’s credit history, your company’s credit history is just as important. This indicates how risky your business is and is something that many suppliers, lenders and other vendors will look at before doing business with you. Equipment financing allows your business to improve its credit history while making monthly payments. By meeting regular deadlines, you show these various stakeholders that your business is reliable and secure enough to meet its monthly obligations.

Final thoughts

Having the latest equipment is essential for any manufacturing company that wants to stay relevant in a highly competitive market. It is no longer possible for a company not to follow the evolution of market demand; any hesitation could expose the company to considerable risks. For a manufacturing company looking to expand, equipment financing is a good option to consider. This offers many advantages that play an important role in the expansion of a company’s business. With more modern equipment at an affordable price, your manufacturing company no longer has to worry about whether or not it can satisfy its customers.

Interesting articles on this topic: Why CNC machining is conquering the manufacturing industry