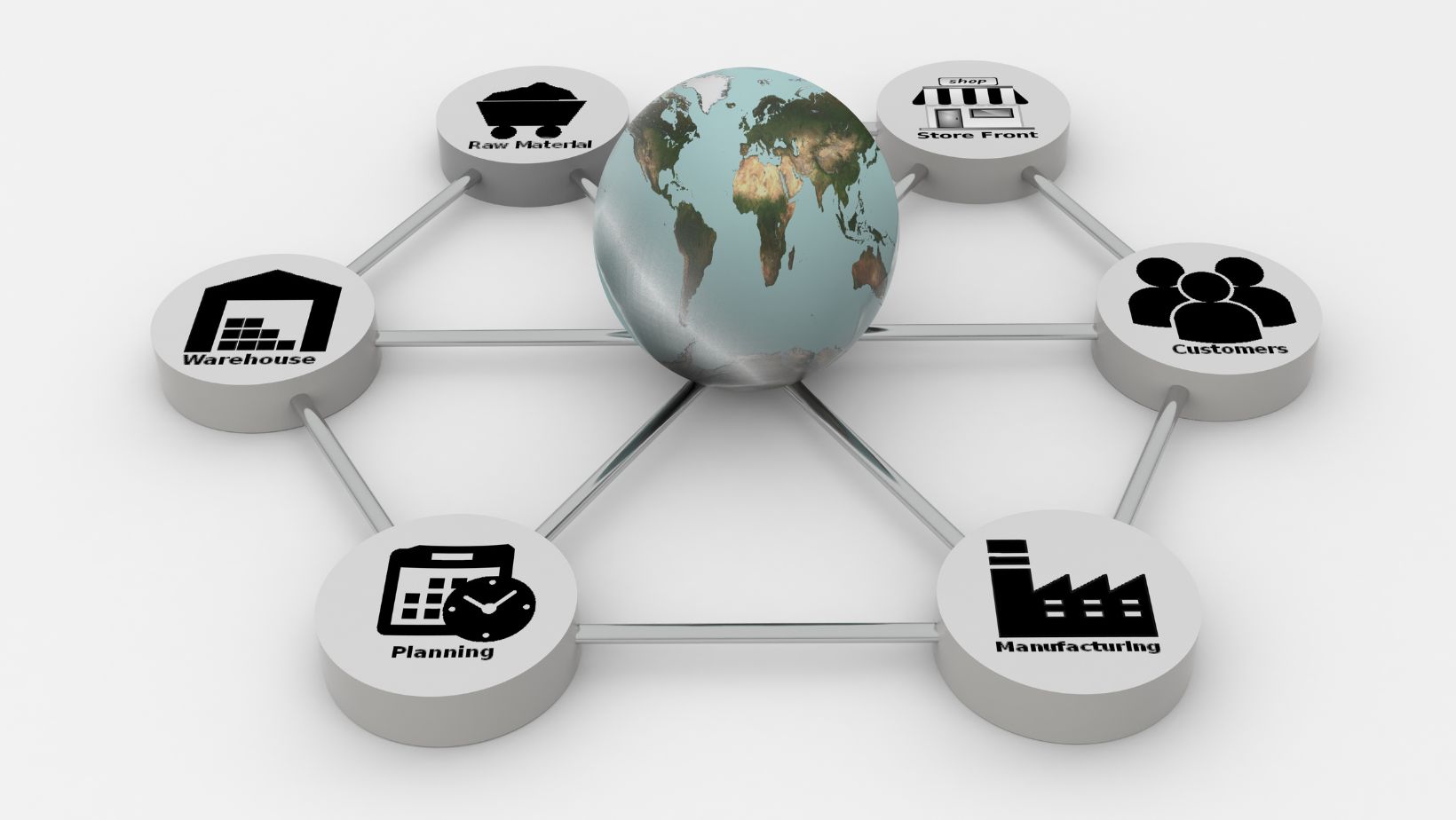

Supply chain financing plays a crucial role in the global economy, enabling businesses to optimize cash flow and enhance operational efficiency. As technology continues to advance, innovations are emerging, reshaping the landscape of supply chain financing. One such innovation is Populous (PPT), a blockchain-based platform that has the potential to revolutionize supply chain finance. From its birth, Bitcoin has come a long way! Read about tracing Bitcoin’s journey to asymmetric profitability.

The Current Challenges in Supply Chain Financing

Before delving into the potential of Populous, let’s first understand the challenges faced in the realm of supply chain financing. Traditional financing methods often involve complex paperwork, lengthy approval processes, and high-interest rates. This creates a burden for small and medium-sized enterprises (SMEs) that rely on smooth cash flow to sustain their operations.

Furthermore, the lack of transparency in the supply chain financing process poses risks for both buyers and suppliers. Delays in payments, disputes, and fraud can hinder the growth of businesses and strain relationships within the supply chain network. These challenges call for innovative solutions that can address the shortcomings of traditional financing methods.

Introducing Populous and its Potential

Populous is a blockchain-based platform that leverages smart contracts and decentralized finance (DeFi) principles to streamline supply chain financing. By utilizing blockchain technology, Populous offers a transparent and secure ecosystem for businesses to engage in invoice financing. The platform connects buyers, suppliers, and investors, facilitating the efficient flow of funds within the supply chain network.

With Populous, SMEs can unlock the value of their outstanding invoices by selling them to investors on the platform. This provides immediate access to working capital, enabling businesses to meet their financial obligations without waiting for lengthy payment cycles. Additionally, investors can take advantage of this opportunity to earn returns by purchasing invoices at a discounted rate.

The Benefits of Populous for Supply Chain Financing

Populous brings several benefits to the table, making it a promising solution for supply chain financing:

Faster and Secure Transactions

Through the use of blockchain technology, Populous ensures fast and secure transactions. The decentralized nature of the blockchain eliminates the need for intermediaries, reducing transaction costs and processing times. Smart contracts enable automated and enforceable agreements, minimizing the risk of fraud and disputes.

Improved Cash Flow Management

By enabling SMEs to sell their invoices for immediate cash, Populous improves cash flow management within the supply chain. This allows businesses to meet their financial obligations on time, maintain smooth operations, and invest in growth opportunities. The ability to access working capital when needed enhances the overall stability of the supply chain network.

Increased Transparency and Trust

Transparency is a fundamental aspect of the Populous platform. All transactions and records are stored on the blockchain, providing a transparent and immutable ledger of financial activities. This increased transparency builds trust among participants in the supply chain, fostering stronger relationships and reducing the risk of payment delays or disputes.

Access to Global Investors

Populous opens up new avenues for SMEs to access a broader network of investors. By leveraging the platform, businesses can showcase their invoices to potential investors worldwide. This global reach increases the likelihood of finding suitable investors and obtaining competitive rates for invoice financing.

The Future of Supply Chain Financing with Populous

As the adoption of blockchain technology continues to grow, Populous has the potential to shape the future of supply chain financing. The platform’s innovative approach streamlines the financing process, making it more accessible, efficient, and secure for businesses of all sizes.

In the future, we can expect to see Populous expand its capabilities and integrate with other emerging technologies. For example, the incorporation of artificial intelligence (AI) and machine learning algorithms could further enhance risk assessment and credit scoring, enabling more accurate and efficient financing decisions.

Additionally, as blockchain technology becomes more widespread and accepted by regulatory bodies, the adoption of Populous is likely to increase. This would create a robust ecosystem where buyers, suppliers, and investors can seamlessly collaborate, leveraging the benefits of decentralized finance and smart contracts.

Conclusion

Populous presents a compelling vision for the future of supply chain financing. By leveraging blockchain technology and smart contracts, the platform offers innovative solutions to the challenges faced by businesses in assessing working capital. With faster transactions, improved cash flow management, increased transparency, and access to a global investor network, Populous is poised to revolutionize the supply chain finance industry.