The Importance of Protecting Personal Information

In today’s digital age, the protection of personal information is of utmost importance. Unauthorized access to Personally Identifiable Information (PII) can have serious consequences, both for individuals and organizations. It is crucial to understand the potential risks associated with the disclosure of PII and take proactive measures to safeguard this sensitive information.

Financial Loss: Unauthorized access to PII can lead to significant financial loss. Cybercriminals can use stolen personal information to commit identity theft, fraud, or other financial crimes. Victims may find themselves facing unauthorized charges, drained bank accounts, and damaged credit. The financial impact can be devastating and take years to recover from.

Reputational Damage: Disclosing PII without permission can also result in severe reputational damage. Organizations that fail to protect their customers’ personal information may face public scrutiny, loss of trust, and damage to their brand reputation. News of a data breach can spread quickly, causing customers to question the organization’s ability to keep their information secure.

Legal and Ethical Considerations: There are legal and ethical obligations surrounding the handling of PII. Many countries have enacted privacy laws and regulations that require organizations to protect personal information and disclose any breaches. Failing to comply with these laws can result in hefty fines, lawsuits, and legal consequences. Moreover, organizations have an ethical responsibility to treat personal information with care and respect the privacy rights of individuals.

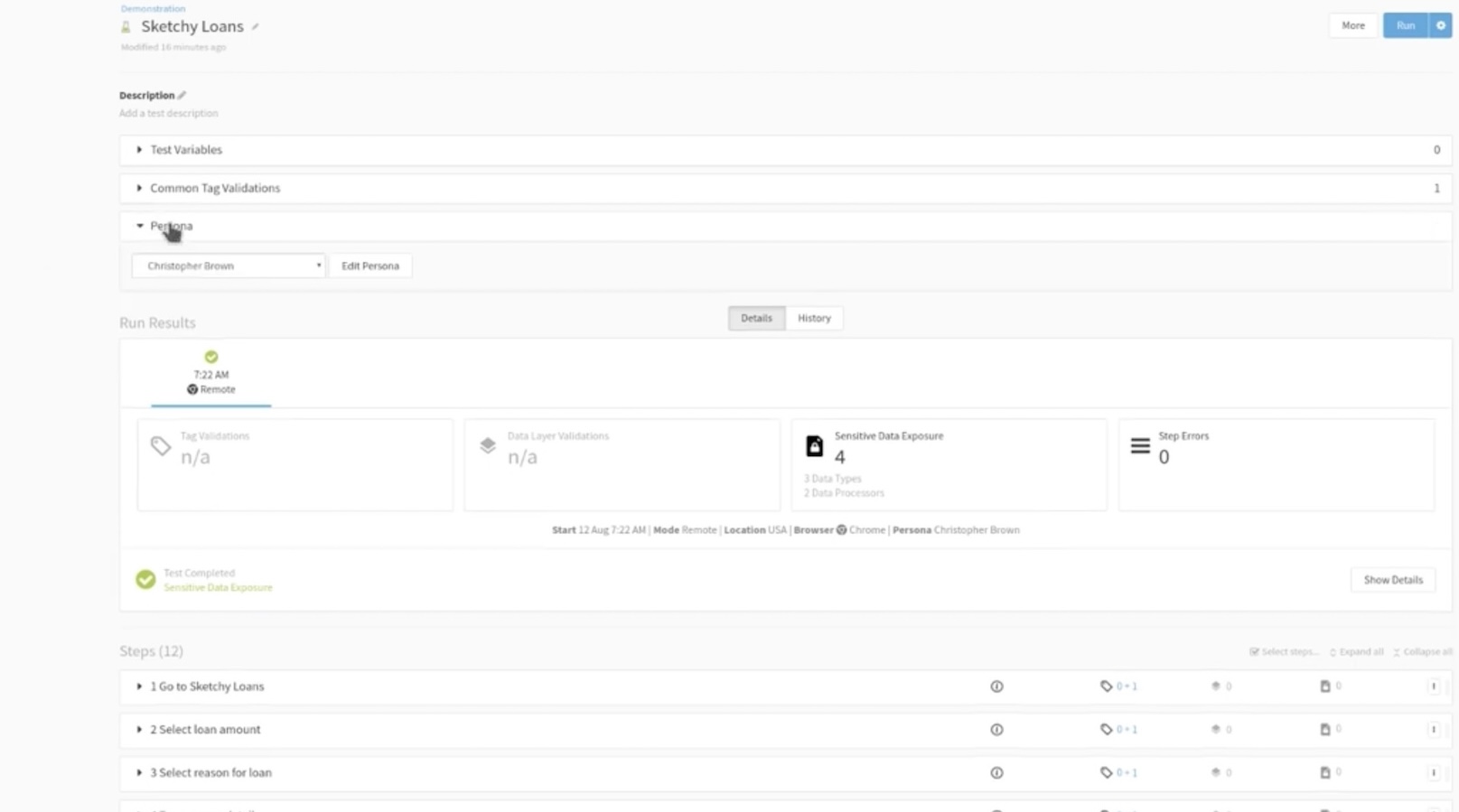

Safeguarding Personal Information: To protect PII, organizations should implement robust security measures. This includes encrypting data, using secure servers and networks, regularly updating software, and educating employees on best practices for handling sensitive information. Additionally, individuals can take steps to safeguard their own personal information, such as using strong passwords, being cautious of phishing scams, and regularly monitoring their financial accounts.

The protection of personal information is vital in today’s digital landscape. The potential risks and consequences of unauthorized access to PII emphasize the need for individuals and organizations to take proactive steps in safeguarding this sensitive information. By prioritizing data security and adhering to legal and ethical obligations, we can help mitigate the risks and ensure the privacy and protection of personal information.

Which of the Following is Not a Permitted Disclosure of PII Contained in a System of Records

Personally Identifiable Information (PII) refers to any information that can be used to identify an individual. It includes but is not limited to:

- Name: This includes a person’s full name, as well as any variations or aliases.

- Contact Information: This includes phone numbers, email addresses, physical addresses, and social media handles.

- Social Security Number: This unique identifier issued by the government is often used for various legal and financial purposes.

- Date of Birth: This information can help identify an individual’s age and is commonly used for verification purposes.

- Financial Information: This includes bank account numbers, credit card information, and any other details related to an individual’s finances.

- Biometric Data: This includes fingerprints, facial recognition data, and DNA samples that can be used to uniquely identify an individual.

- Health Information: Medical records, health insurance information, and any other data related to an individual’s physical or mental health fall under this category.

- Online Identifiers: IP addresses, usernames, and passwords used for online accounts are considered PII.

It’s important to note that PII can be either directly identifiable, such as a person’s name, or indirectly identifiable, such as a combination of non-specific data points that, when combined, can be used to identify an individual.

To better understand what constitutes PII, here are some common examples:

- Social Media Profiles: Information shared on social media platforms, such as Facebook, Twitter, and LinkedIn, can contain PII, including personal photos, employment history, and educational background.

- Online Shopping: When making a purchase online, you may be required to provide PII such as your name, address, and credit card information.

- Healthcare Records: Medical records, insurance claims, and prescriptions contain sensitive PII related to an individual’s health.

- Financial Transactions: Banking information, credit card statements, and tax documents all contain PII.

- Employment Records: Employee files, including resumes, contracts, and payroll information, contain PII.

It’s crucial to understand the breadth of information that falls under PII. By recognizing the various forms PII can take, we can better protect and safeguard this sensitive data from unauthorized access and disclosure.