Being saddled with a bad credit score can make it feel like there are no good options available when you need money for an unexpected expense or to cover some bills. Don’t despair: Several loan providers offer “bad credit loans US” or no refusal payday loans in Canada,” even if your credit score isn’t perfect.

In this post, we’ll discuss the best bad credit loans that offer guaranteed approval in 2023, so you can get the financial support you need while rebuilding (or maintaining) your credit history and score. Keep reading to learn more!

Understanding Bad Credit Loans

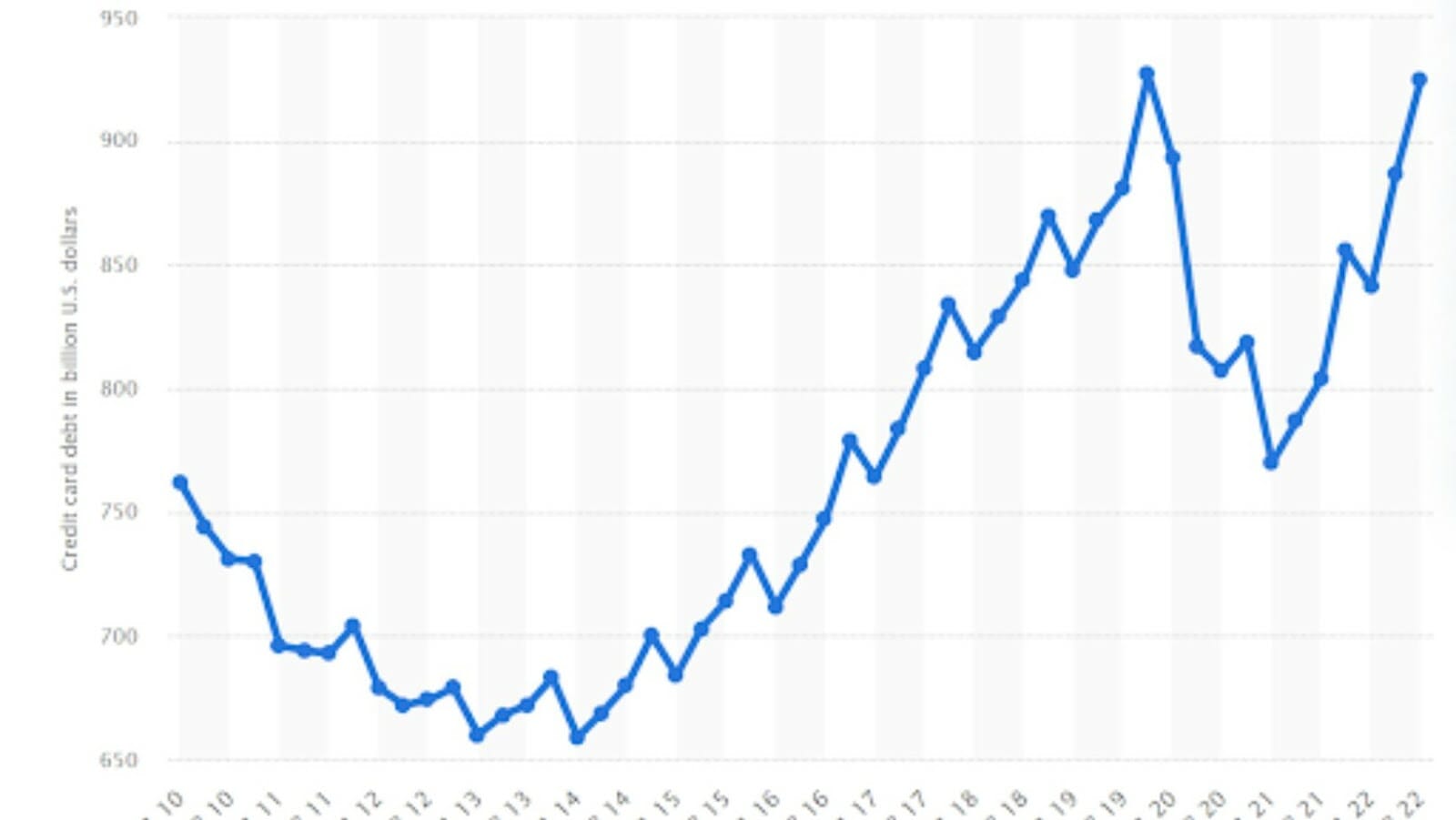

Bad credit loans can be a daunting and confusing topic, but understanding them is crucial in times of financial need. The popularity of loans is high, and the statistics prove it. For instance, in comparison to the same quarter of the previous year, credit card debts in the United States surged by more than 40 billion dollars.

Essentially, bad credit loans are loans that are designed for individuals with poor credit scores or credit histories.

This means that these loans may have higher interest rates and stricter repayment terms. While they may not be ideal, bad credit loans can provide a necessary lifeline in certain situations, such as unexpected expenses or emergencies.

It is important to carefully consider the terms and conditions of these loans before signing anything and to make sure you can realistically afford the repayments. With some research and careful planning, bad credit loans can be a helpful tool to rebuild your credit and get your finances back on track.

What are the Advantages of a Bad Credit Loan with Guaranteed Approval

One of the main perks of guaranteed approval for a bad credit loan is that the lender may approve the loan without scrutinizing the borrower’s credit history. This means that people with low credit scores can get a loan without enduring a long and stressful analysis process.

Additionally, bad credit loans often have more lenient repayment terms, so borrowers can make smaller payments over a longer time to repay the loan.

Another advantage is that the loan can be used for various purposes. Borrowers can use the money to pay off medical bills, purchase a car, make home improvements, or even cover tuition fees.

This makes it easier for individuals to get the funds they need to cover their expenses without relying on traditional lenders who may not be willing to approve their loan applications.

Moreover, credit loans allow borrowers to improve their credit scores. By making timely payments and keeping balances low, borrowers can gradually enhance their scores and become more desirable to future lenders. This can pave the way for better interest rates and more loan opportunities later.

What are the Disadvantages of a Bad Credit Loan with Guaranteed Approval

Bad credit loans with guaranteed approval can sound like a great deal for those with poor credit. Still, these loans come with a few drawbacks that should be considered before taking out a loan.

The first disadvantage of bad credit loans is the higher interest rates. Non-traditional loans often entail higher interest rates, escalating overall expenses for the borrower. Furthermore, additional costs like increased fees and other charges can accrue steadily, amplifying the financial burden.

One more drawback of these loans is the shorter repayment terms. Typically, they necessitate quicker repayment, pressurizing borrowers to settle the dues sooner. This can lead to budgetary difficulties and impede their financial planning as they have to make regular payments frequently.

Bad credit loans with guaranteed approval may seem like a good option, primarily if you’re dealing with poor credit. However, weigh the pros and cons carefully before applying for a loan. You must make an informed decision once you examine the potential drawbacks. Take time to consider if this is the right choice for you.

How to Choose the Best Bad Credit Loan

In need of financial assistance, bad credit loans may seem like the only option for those with a less-than-stellar credit score. However, not all bad credit loans are created equal. That’s why it’s essential to do your research and compare your options before jumping into any loan agreement.

Start by assessing your financial situation and determining how much you can realistically afford to borrow. From there, compare various lenders’ interest rates, fees, and repayment plans.

Don’t forget to check for any red flags, such as hidden fees or high-interest rates, before signing on the dotted line. You can choose the best bad credit loan for your unique financial needs with careful consideration and patience.

Best bad credit loans with guaranteed approval available in 2023

We’ve researched and selected the best bad credit loans with guaranteed approval in April 2023. With flexible loan amounts and low-interest rates, these loans can help you get the cash you need while also improving your credit score. Plus, you can apply online from the comfort of your home. Let’s explore these loan options and find the one that’s right for you.

- LendingPoint: With loan amounts ranging from $2,000 to $36,500, LendingPoint provides a smooth, user-friendly application process and flexibility in repayment terms, making it an excellent option for borrowers with limited credit history.

- Avant: Avant offers personal loans ranging from $2,000 to $35,000 with flexible repayment terms of up to 60 months. Avant provides qualified applicants with a simple online application process and same-day funding.

- Upstart: Upstart specializes in providing loans to borrowers with a limited credit history of at least six months. The loan amounts range between $1,000 to $50,000, and borrowers can repay their loans in three to five years. The automatic approval process is fast and could yield loan rates that are lower than other competitors.

- OneMain Financial: If you’re looking for a secured loan with bad credit, OneMain Financial may be a good fit. With this lender, borrowers can qualify for a personal loan of up to $20,000 and may be able to use their car or other assets as collateral.

- Best Egg: Best Egg offers personal loans of up to $35,000 with flexible repayment terms of up to 5 years. Qualified borrowers may receive their funds within one business day and benefit from rate reductions when consolidating their debt.

Conclusion

Understanding your credit score and the best loan options for bad credit can help you access funding at reasonable terms. Deciding to take out a bad credit loan is not easy and should be considered carefully to ensure it is the right fit for you.

If you need better credit, several loan options with guaranteed approval in 2023 may work for you and provide a competitive advantage. It’s important to analyze multiple options from different lenders before signing any agreement to ensure the loan features, repayment terms, and other details meet your financial needs.

With the proper preparation and research, a bad credit loan with guaranteed approval in 2023 can be an invaluable asset when dealing with financial hardship.