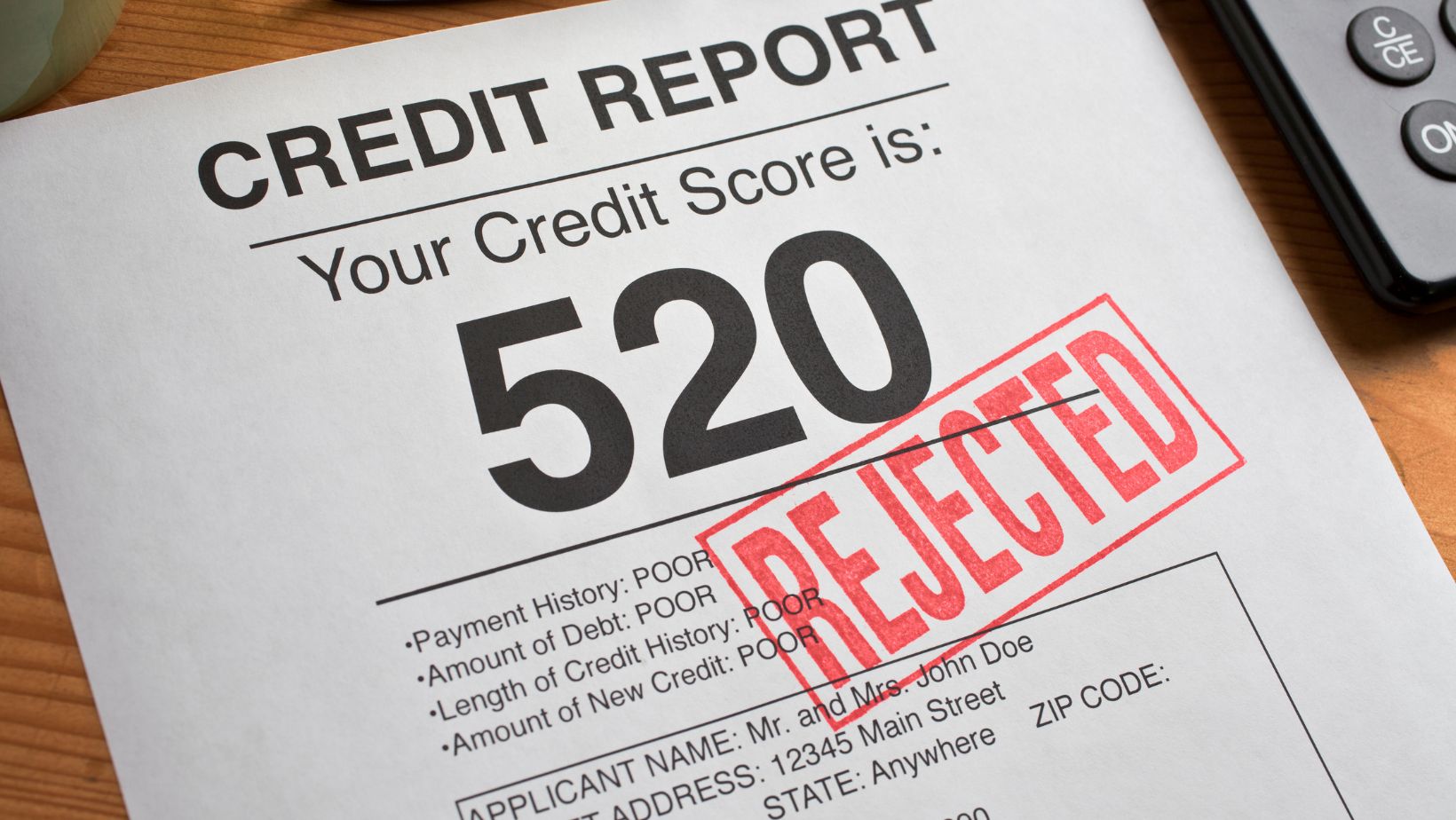

Improving your credit score is a crucial step towards financial freedom and stability. It not only helps you get approved for loans and credit cards but also affects the interest rates you’ll be offered. Unfortunately, the journey to better Credit is fraught with misinformation and scams that prey on those desperate to improve their financial standing. This article outlines five legitimate steps you can take to enhance your credit score without falling victim to these pitfalls.

Understand Your Credit Report

The first step in improving your credit score is to have a thorough understanding of your credit report. Your credit report contains the details of your credit history, including accounts, payment histories, and any derogatory marks such as collections or bankruptcies.

- Regular Monitoring: Begin by obtaining a copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. You’re entitled to one free report from each bureau every year through AnnualCreditReport.com. Regular monitoring of your credit report allows you to spot errors or fraudulent activities early on.

- Dispute Inaccuracies: If you find any inaccuracies, dispute them immediately with the credit bureau. This can include payments marked as late that were paid on time, accounts that aren’t yours, or incorrect credit limits. Each credit bureau has a process for disputing errors, and removing these inaccuracies can improve your credit score.

For those who find the process of disputing inaccuracies daunting or time-consuming, seeking assistance from reputable credit repair services can be a valuable next step. For insights on choosing the best credit repair services to suit your needs, refer to this comprehensive guide on the Best Credit Repair Services. This guide will help you navigate your options and make an informed decision on which service might be best for you.

Reduce Your Credit Utilization Ratio

Your credit utilization ratio is a critical factor in your credit score calculation, accounting for about 30% of your FICO score. It measures the amount of Credit you’re using compared to your total available Credit.

- Keep Balances Low: Aim to keep your credit card balances below 30% of your credit limits. For instance, if you have a credit card with a $10,000 limit, try not to carry a balance greater than $3,000.

- Pay Down Debts: If possible, pay down existing debt to lower your utilization. Consider using the debt snowball or avalanche method to efficiently reduce balances.

Pay Bills on Time

Payment history is the most significant component of your credit score, making up 35% of your FICO score. Late payments can severely damage your credit score, so it’s crucial to pay all your bills on time.

- Set Up Reminders: Use calendar alerts or set up automatic payments for your minimum amounts due to ensure you never miss a payment.

- Catch Up on Past Due Accounts: If you have any accounts that are past due, bring them up to date as soon as possible. The longer an account remains delinquent, the more it hurts your credit score.

Limit New Credit Inquiries

Every time you apply for Credit, a hard inquiry is recorded on your credit report, which can temporarily lower your score. While one inquiry might only have a minor impact, multiple inquiries in a short period can significantly affect your score.

- Apply for Credit Sparingly: Only apply for new Credit when absolutely necessary. If you’re shopping for a loan, try to do so within a short time frame, as credit scoring models often count multiple inquiries for the same type of loan as a single inquiry if done within 14 to 45 days.

- Pre-qualification: Many lenders offer pre-qualification checks that only use soft inquiries, which don’t affect your credit score. Use these to gauge your approval chances before applying officially.

Use Credit Wisely

Responsible credit use is fundamental to building and maintaining a good credit score. This means not only managing your debts wisely but also understanding the types of Credit available and how to use them to your advantage.

- Diversify Your Credit: Having a mix of credit types, such as revolving Credit (credit cards) and installment loans (auto loans, mortgages), can positively affect your score. This diversity shows lenders you can manage different types of Credit responsibly.

- Keep Old Accounts Open: The length of your credit history accounts for about 15% of your credit score. Keep older accounts open, even if you’re not using them, to lengthen your credit history. However, ensure these accounts do not have high annual fees that would not make this worthwhile.

In conclusion, improving your credit score is a methodical process that requires patience, diligence, and smart financial decisions.

By understanding and taking charge of your credit report, reducing your credit utilization, paying bills on time, limiting new credit inquiries, and using Credit wisely, you can enhance your credit score legally and effectively. Avoid any offers that promise quick fixes or require upfront fees, as these are often signs of scams. Remember, improving your credit score is a marathon, not a sprint, and making consistent, responsible financial decisions is key to reaching your goal.