Some taxpayers do their taxes, while others pay professionals to complete the paperwork and submit their tax returns. No matter whether you are planning to file your own taxes or turn to a certified professional, it’s important to understand how to organize your documents, forms, and receipts.

When you are prepared and know what to expect, you will be able to get through this process easily and fast. Keep on reading to learn about the three best tax preparation methods.

Tax Preparation Methods

When you are strapped for funds and urgently need additional money, you seek the best-unsecured loans. When you are planning to file your taxes, you seek the best tax preparation method. There are three options to prepare your tax return:

- Use the tax calculator and submit the paper form yourself.

- Select tax software, either free or paid, and get your taxes filed.

- Choose a tax professional to do the work for you.

Here are the main features of each method to help you decide:

The complexity of the tax situation

If you choose to file your taxes on paper, it can be a bit more complicated compared to filing them with the help of a software or hiring a specialist.

Required time

If you file the taxes using paper forms, it will take you from one to seven days. Those who utilize software will need just one or two days while hiring a tax specialist will save you precious time as the professional will do all the work for you.

Expenses

It is free to file taxes yourself. The tax software can be free or paid. Basic software may cost you up to $50, while advanced tax apps will cost from $50 to $100. Hiring a specialist is the most expensive option and will cost from $175 to $300.

Personal effort

It doesn’t take any effort to get your taxes filed by a specialist, it will take some effort to do this task using software, but it will take high effort to fill out all the necessary paper forms.

Useful Tips Before You Prepare Your Taxes

Collect Your Documents

Those who file their taxes by paper may need to get tax forms and publications. Various instructions, worksheets, and forms can be found on this platform. Besides, you can receive a transcript or a copy of a prior year’s tax return here. There is a $43 fee for every tax return requested. The request will be processed by the IRS within 75 calendar days.

All the necessary tax papers should be gathered from your recruiter or recruiters as well as from brokerage firms, banks, and other institutions you cooperate with. It should be done by the end of January. The most common forms for filling out include Form W-2 for employed people, Form 1098 for submitting information about any mortgage interest a person paid, Form W-2G for gambling winnings, etc.

Select a Tax Preparer

If you don’t want to spend your own time and effort preparing taxes and filling out numerous documents, you may turn to a professional tax preparer. You may ask your advisors and friends to advise you or give referrals.

One of the most important things this specialist should have is a preparer tax identification number (PTIN). It shows the person is authorized to conduct such tasks and prepare tax returns. Besides, you need to ask about their fee or compensation. Don’t turn to the company that asks for a percentage of the tax refund.

Round Up Your Receipts

Depending on whether you claim the standard deduction or itemize your deductions, you will need different receipts. Select the deductions that produce the larger write-off. If you add your itemized deductions and compare them with the standard deduction, you will be able to decide which option is beneficial for you. The standard deduction for a single taxpayer is $12,950 for 2022, and it will be $13,850 for 2023.

Mention Your Personal Data

You should know not just your own Social Security number (SSN) but also the numbers of every dependent you claim. Make sure you keep this private data in a safe place. Addresses may also be needed if you own rental property or a vacation home. Have you sold some property last year? Save the dates you sold and bought it as well as the sum you paid for it and the amount you obtained from the sale.

Plan for Any Refund in Advance

Those who want to have a tax refund need to understand this process. A person may apply a portion or all of the tax refund for the next year’s taxes. Those who pay estimated taxes during the year can benefit from this option and cover their first quarterly installment. Particular types of accounts (education savings accounts, health savings accounts, IRAs) can have a portion or all of your refund. Besides, you may want to purchase US savings bonds using TreasuryDirect.

Watch Out for Penalties

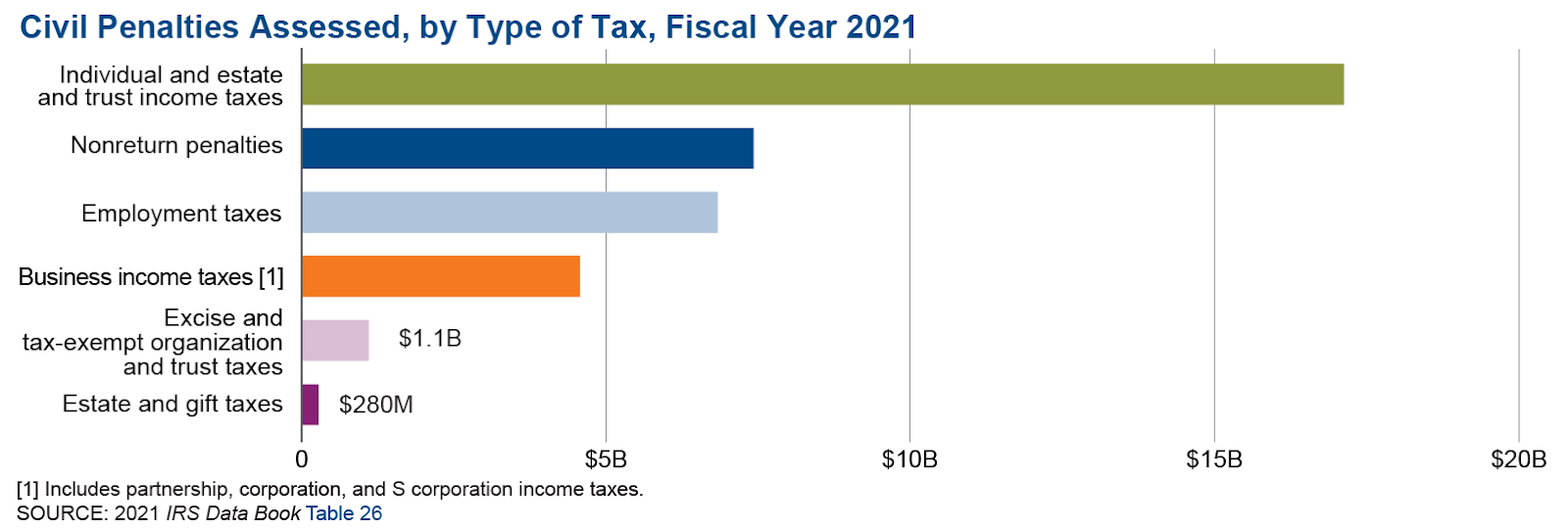

You should keep in mind that failure to comply with reporting, filing, or payment demands may lead to civil penalties and even criminal investigations. This section of the IRS Data Book includes data on penalties and collections resulting from people’s or entities’ failure to comply with the tax laws.

The IRS collected over $92.6 billion in unpaid assessments on returns filed with extra tax due, netting $59.5 billion after credit transfers in the fiscal year 2021.

When is the deadline for filing your tax returns? You need to finish this process by April 15, following the tax year. On the other hand, taxpayers can file their 2022 tax returns till April 18, 2023. The general expense for tax preparation using Form 1040 was $220 in 2020.

The Bottom Line

Summing up, there are three options for how you can prepare your tax return. You can fill out the paper documents and submit them yourself; you may opt for tax software or hire a tax specialist. Each method has pros and cons. Depending on your tax situation, the amount of time you have, how much you want to spend, and how involved you want to be, you can select the most suitable option.