Can You Cash a Check if Your Account is Negative

Cashing a check when your account is negative can be a tricky situation. However, it ultimately depends on the policies of your bank or financial institution. In some cases, if you have overdraft protection or a line of credit linked to your account, the bank may allow you to cash the check and cover the negative balance. It’s important to note that this can come with additional fees and interest charges.

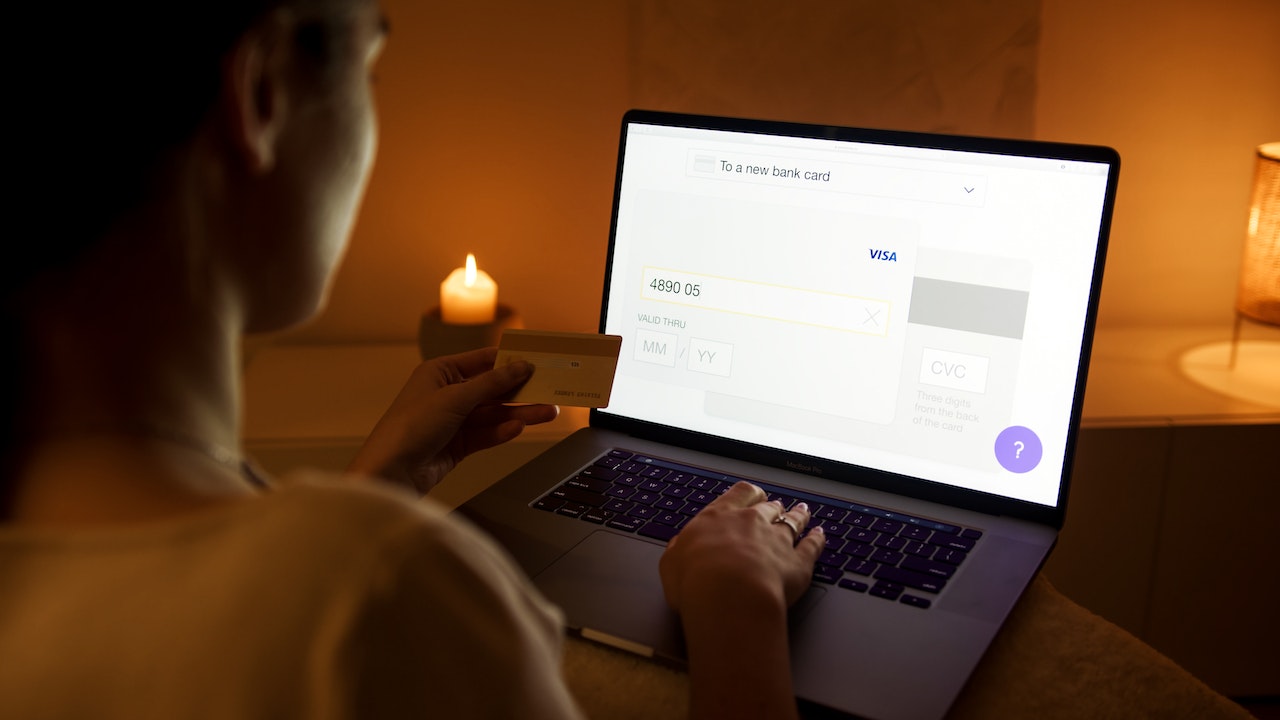

To protect yourself from potential check-cashing scams, there are several steps you can take. First and foremost, be cautious when accepting checks from unfamiliar individuals or businesses. Scammers often use fraudulent checks to trick unsuspecting victims into providing goods or services before the check clears.

The Risks Involved in Cashing Checks with a Negative Balance

Cashing a check when your account is already in the negative can be tempting, especially if you’re facing financial difficulties. However, it’s important to understand the risks involved before making such a decision. Let’s delve into the potential pitfalls and why it’s crucial to protect yourself from check-cashing scams.

- Insufficient Funds Penalty: When you cash a check with a negative balance, your bank may charge you an additional fee known as an insufficient funds penalty. This fee can compound your financial troubles and make it even harder to get back on track. It’s essential to carefully consider whether this extra cost is worth it and explore alternative options like negotiating with the issuer or seeking assistance from financial institutions.

- Legal Consequences: Attempting to cash a check with insufficient funds can have legal repercussions. Writing bad checks or knowingly engaging in fraudulent activities is against the law in many jurisdictions. If caught, you could face fines, legal proceedings, and even criminal charges. It’s always better to address financial difficulties transparently and seek legitimate solutions rather than resorting to potentially illegal actions.

- Damage to Credit Score: Cashing checks when your account is negative can negatively impact your credit score. Banks report these incidents of overdrafts and bounced checks to credit bureaus, which can lead to lower credit scores over time. A lower credit score may make it challenging for you to obtain loans or other forms of credit in the future.

- Check-Cashing Scams: Another risk associated with cashing checks when your account is negative is falling victim to check-cashing scams. Fraudsters often target individuals who are desperate for money by offering them seemingly legitimate opportunities that promise quick cash without considering their account balance or background checks.

These scams typically involve scenarios where they ask you to deposit a large sum into your account and then immediately withdraw part of that amount as payment. However, the deposited check is later revealed to be fake or forged, leaving you responsible for repaying the full amount to the bank. To protect yourself from such scams, it’s crucial to exercise caution, verify the legitimacy of any offers or opportunities before acting on them, and report any suspicious activities to the authorities.

Recognizing Warning Signs of Check-Cashing Scams

When it comes to protecting yourself from check-cashing scams, being able to recognize the warning signs is crucial. Here are some key indicators that should raise a red flag and prompt you to proceed with caution:

- Unsolicited Checks: If you receive a check out of the blue from someone you don’t know or for no apparent reason, be wary. Scammers often send unsolicited checks as a way to bait unsuspecting individuals into their fraudulent schemes.

- High Urgency: Beware of anyone pressuring you to cash a check quickly or urging you to act immediately. Scammers often use high-pressure tactics, claiming that time is running out or offering enticing rewards to lure victims into depositing the check without proper verification.

- Overpayment Requests: Be cautious if someone sends you a check for an amount higher than what is owed and asks you to return the excess funds via wire transfer or another method. This could be an attempt to scam you by exploiting the time delay in processing checks, leaving you responsible for repaying any fraudulent funds withdrawn against the deposited check.

- Inconsistent Information: Pay close attention to inconsistencies in names, addresses, or other details on the check itself or accompanying documents. Legitimate checks typically have accurate and consistent information, while scammers may make mistakes or provide misleading information.

- Unusual Conditions: Watch out for unusual conditions attached to the check-cashing process, such as having to pay upfront fees or providing personal financial information beyond what is necessary for standard transactions. These requirements are often indicators of fraudulent activities.

- Poor Quality Checks: Examine the physical appearance of the check closely. Look for signs of poor printing quality, smudged ink, misspelled words, or altered numbers – these can all be indications that something is not right.

Remember that these warning signs are not foolproof indicators on their own, but rather red flags that should prompt you to investigate further before cashing a check. If something seems suspicious or too good to be true, it’s essential to exercise caution and protect yourself from potential check-cashing scams.